Buying a home is a significant financial commitment, and while most buyers focus on the property’s purchase price, there are many hidden costs that can impact your budget. From legal fees to maintenance expenses, these additional costs can quickly add up. In Dubai, understanding the financial aspects regulated by the Dubai Land Department and factors like the rental index can help buyers make informed decisions. This article explores the hidden costs associated with purchasing a home and how to prepare for them.

1. Government Fees and Taxes

Dubai Land Department Fees

One of the major costs when buying a home in Dubai is the Dubai Land Department (DLD) fee, which is typically 4% of the property’s purchase price. This fee is mandatory and must be paid at the time of property transfer.

Property Registration Fees

For properties valued over AED 500,000, the registration fee is AED 4,000, while properties below this threshold require a fee of AED 2,000. These costs are in addition to the DLD fee.

Mortgage Registration Fee

If you’re financing your home with a mortgage, the Dubai Land Department charges a mortgage registration fee, which is 0.25% of the total loan amount.

2. Real Estate Agent Commissions

Real estate agents play a crucial role in helping buyers find the right property, but their services come at a cost. Typically, agents charge a commission fee of around 2% of the property price. This amount is paid upon finalizing the transaction.

3. Service Charges and Maintenance Fees

Many properties, especially those in gated communities and high-rise buildings, require homeowners to pay annual service charges. These fees cover maintenance, security, and communal facilities. The rental index published by the Dubai Land Department helps homeowners estimate these costs based on market rates.

4. Home Inspection and Valuation Costs

Before finalizing a purchase, conducting a home inspection is advisable to identify any structural issues. Professional inspection services typically cost between AED 1,500 to AED 3,000. Additionally, if you’re using a mortgage, lenders may require a property valuation, which can cost around AED 2,500.

5. Mortgage-Related Costs

Bank Processing Fees

Most banks charge a processing fee for mortgage applications, which can range from 0.5% to 1% of the loan amount. This cost should be factored into your home-buying budget.

Early Settlement Fees

If you plan to repay your mortgage ahead of schedule, be aware that banks may charge an early settlement fee, usually around 1% of the outstanding loan amount.

6. Moving and Utility Connection Costs

Moving Expenses

Hiring professional movers can be costly, with prices ranging from AED 1,500 to AED 5,000, depending on the distance and volume of belongings.

Utility Connection Fees

Setting up water, electricity, and internet services involves connection fees. For example, DEWA (Dubai Electricity and Water Authority) requires a security deposit of AED 2,000 for apartments and AED 4,000 for villas.

7. Home Insurance Costs

While not mandatory, home insurance is highly recommended to protect your investment. Policies range from AED 1,000 to AED 5,000 annually, depending on coverage and property value.

8. Renovation and Furnishing Costs

Many homeowners choose to renovate or furnish their property before moving in. This can be a significant expense, with furniture costs alone reaching tens of thousands of dirhams.

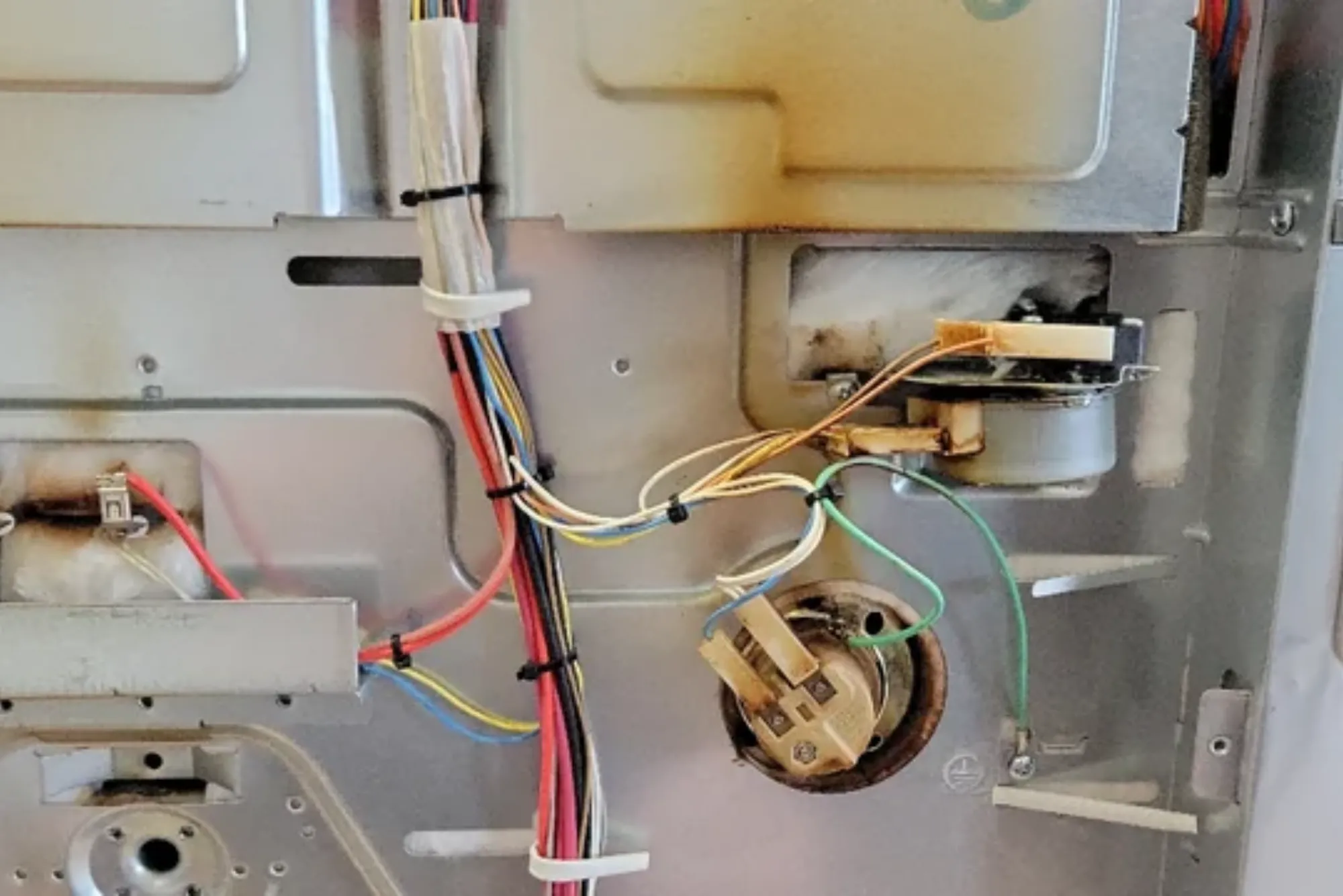

9. Unexpected Repair and Maintenance Costs

Over time, homes require repairs such as plumbing, electrical work, and AC maintenance. Setting aside an emergency fund for unexpected expenses is crucial.

10. Impact of Rental Index on Homeownership Costs

The rental index published by the Dubai Land Department provides insights into current rental trends, which can influence property prices and service charges. Understanding these trends helps buyers anticipate long-term costs and make strategic investment decisions.

Conclusion

While purchasing a home is an exciting milestone, understanding the hidden costs can prevent financial surprises. Buyers should account for government fees, agent commissions, maintenance expenses, and mortgage-related costs to ensure a smooth purchasing experience. Utilizing resources like the Dubai Land Department and the rental index can provide valuable insights into ongoing property expenses. By planning ahead, homebuyers can make well-informed decisions and secure their investment with confidence.