what is an escrow agreement in real estate-What is an Escrow Agreement in Real Estate?

An escrow agreement is a legal document that outlines the terms and conditions of a real estate transaction between two parties. It safeguards both the buyer and seller by ensuring that all parties involved fulfill their obligations before the transaction is completed. In this article, we will discuss an escrow agreement, its purpose in real estate transactions, and the different types of escrow agreements.

What is an Escrow Agreement?

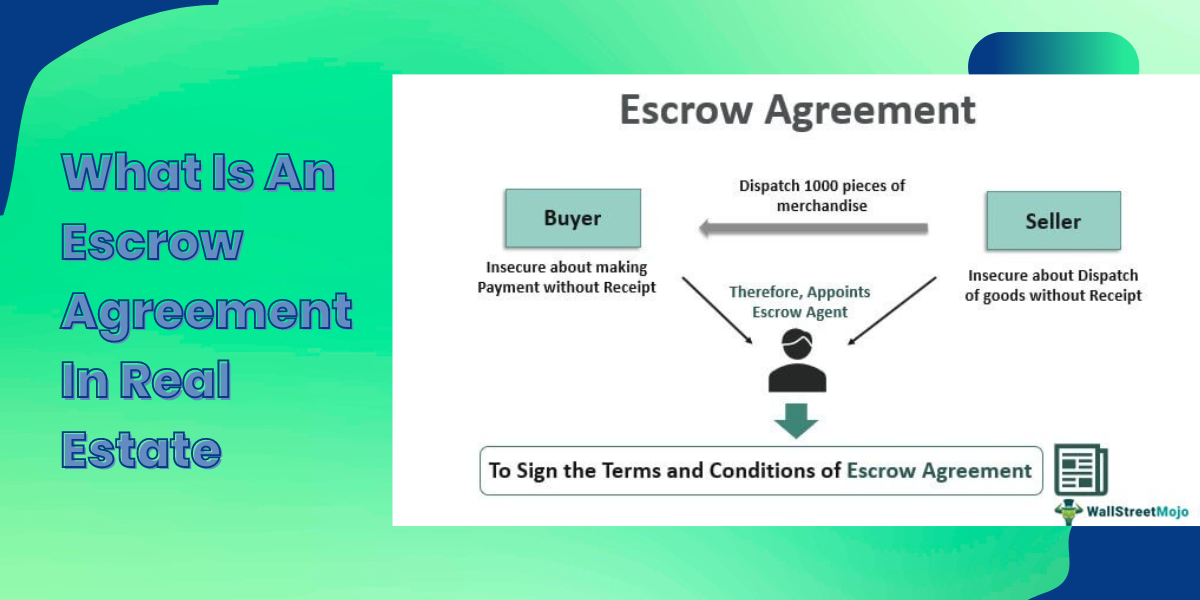

An escrow agreement is a legal document that outlines the terms and conditions of a real estate transaction. It is a binding agreement between two parties, usually a buyer and a seller, that sets out the terms of the transaction and the responsibilities of each party. The agreement is held by a third-party agent, known as an escrow agent, who is responsible for ensuring that all the agreement terms are fulfilled before the transaction is completed.

Purpose of an Escrow Agreement:

The purpose of an escrow agreement is to protect both the buyer and seller in a real estate transaction. The agreement ensures that the buyer has the necessary funds to complete the transaction and that the seller has the documents to transfer ownership of the property. The escrow agent serves as a neutral party and helps facilitate the transaction by ensuring that all the agreement terms are fulfilled before the transaction is completed.

Types of Escrow Agreements:

Several different types of escrow agreements can be used in real estate transactions. These include:

- Purchase Agreement Escrow: This type of escrow agreement is used when a buyer and seller enter into a purchase agreement for a property. The agreement outlines the terms of the sale, including the purchase price, closing date, and any contingencies that must be met before the sale can be completed.

- Earnest Money Escrow: An earnest money escrow agreement is used when a buyer provides a deposit to the seller to show their intention to buy the property. The earnest money deposit is held in an escrow account until the transaction is completed, at which point it is applied toward the property’s purchase price.

- Construction Escrow: A construction escrow agreement is used when a lender funds a construction project. The funds are held in an escrow account and released to the contractor as the project progresses and certain milestones are met.

- Leasehold Escrow: A leasehold escrow agreement is used when a tenant takes possession of a property before the lease agreement is signed. The escrow agent holds the security deposit and first month’s rent until the lease agreement is signed, at which point the funds are released to the landlord.

Conclusion:

An escrow agreement is a crucial part of a real estate transaction, as it helps to protect both the buyer and seller. The agreement outlines the terms of the transaction and the responsibilities of each party and is held by a neutral third-party escrow agent. Several types of escrow agreements can be used in real estate transactions, including purchase agreement escrow, earnest money escrow, construction escrow, and leasehold escrow. Buyers and sellers can ensure a smooth and successful real estate transaction by understanding the different types of escrow agreements.